The Portfolio Is Bouncing Back

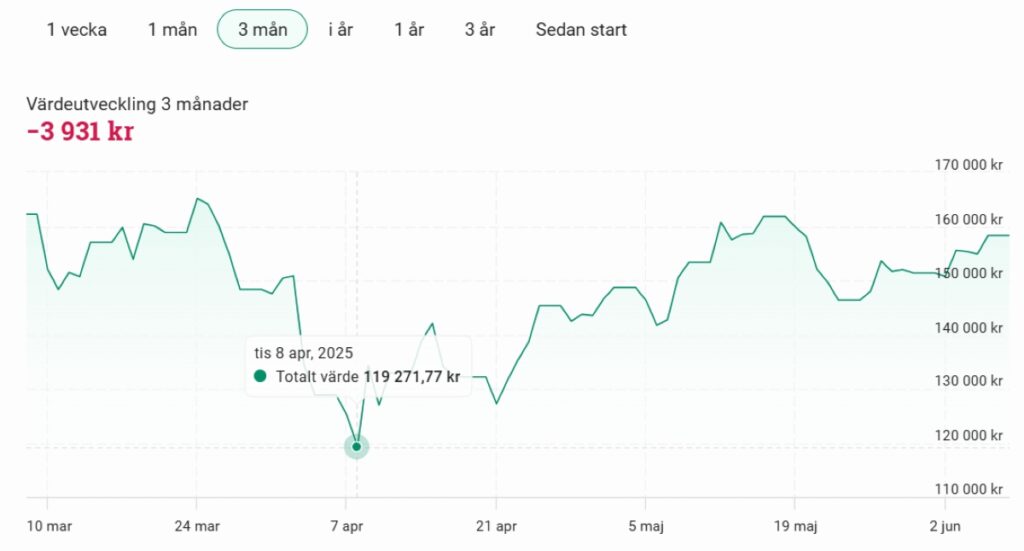

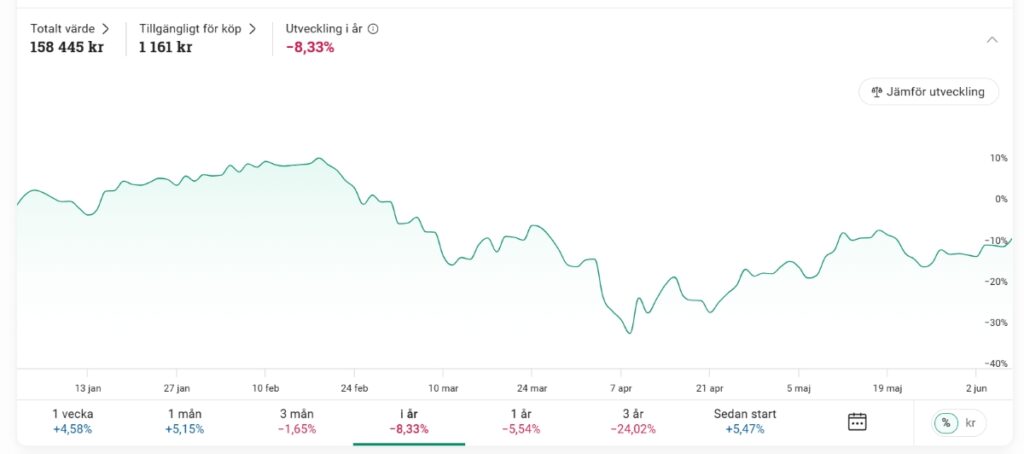

I have to start by saying that quite a bit has happened since my last update. Back in April, my portfolio was valued at 127,400 SEK, and now it’s up to 158,445 SEK. It hit a low point on April 8th, dropping to 119,271 SEK. I haven’t added any funds since then. In fact, I even withdrew 1,000 SEK. So, I must say the portfolio has recovered incredibly fast.

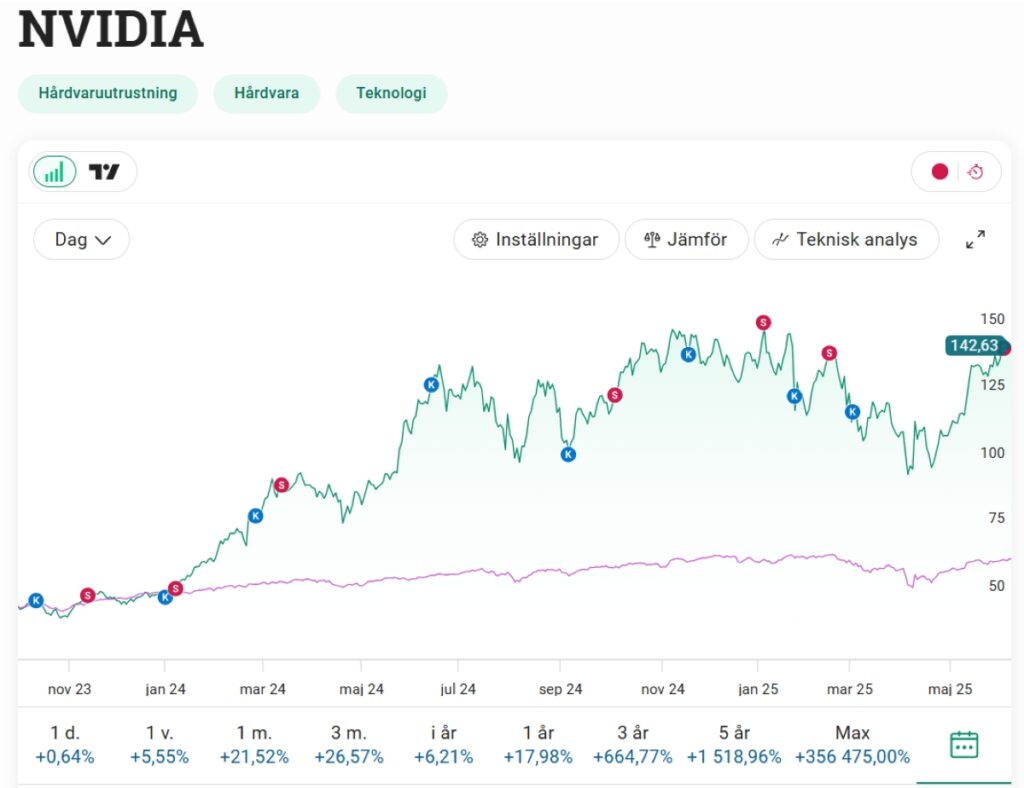

Nvidia

Nvidia’s earnings report at the end of May was strong, and I still believe in the company long-term. That said, I decided to lock in some profit. The markets are likely to remain volatile amid tariffs and other geopolitical uncertainties. Whenever I see a profit of over 1,000 SEK, it becomes very tempting to take it, and this time I did just that.

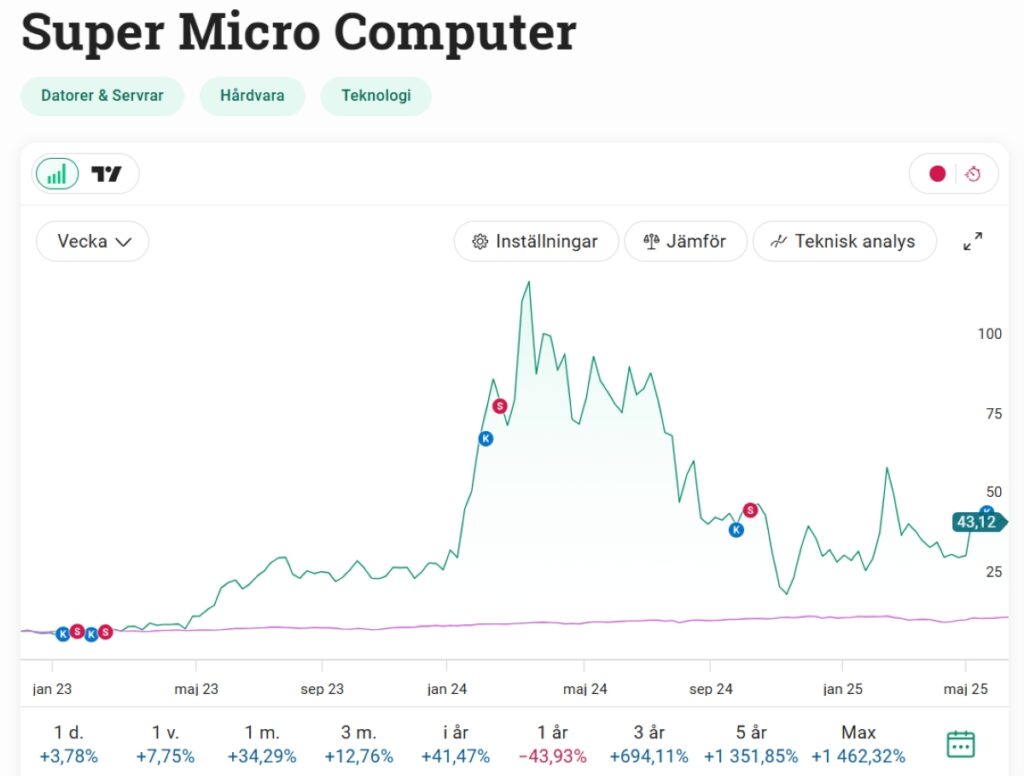

Super Micro Computer

I continue to view Super Micro Computer as an exciting investment opportunity. Sure, the competition is fierce and much of its future growth is probably already priced in. But the stock is riding the AI boom, and there’s speculation that a short squeeze might happen. This is a highly volatile position that I view as a pure high-risk/high-reward play. At the moment, I’m down 760 SEK, but that’s still within the loss limit I’m comfortable with.

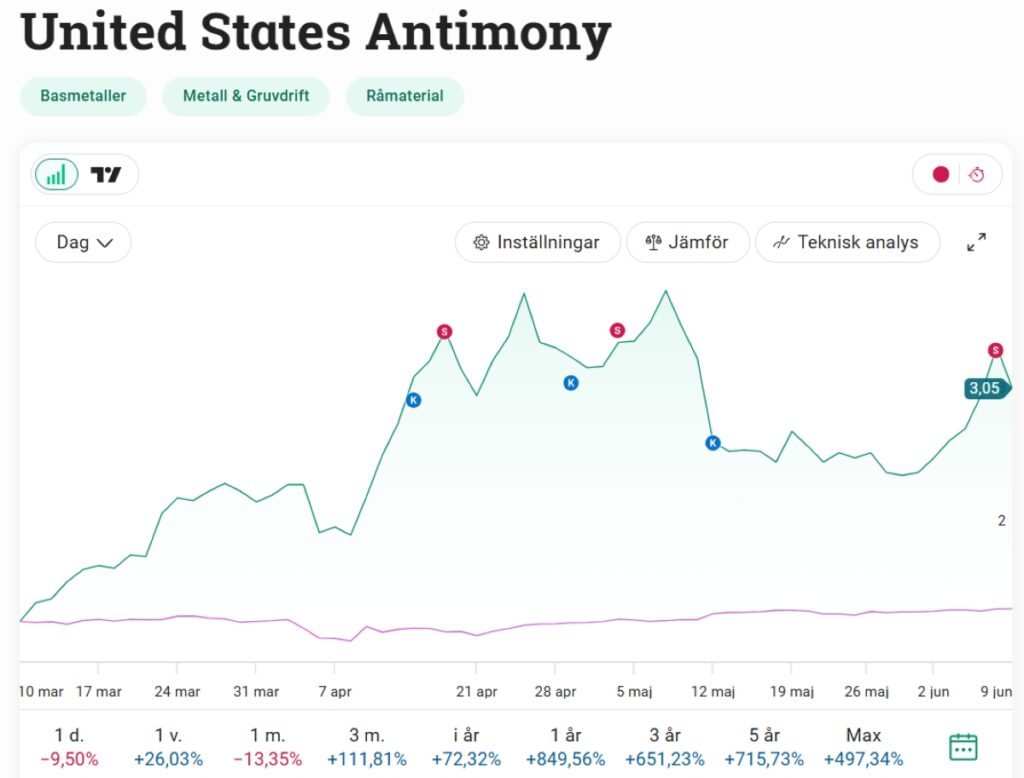

United States Antimony

After a few rounds of buying and selling, I’ve currently exited my position, but it remains firmly on my watchlist. As long as geopolitical tensions remain high, I’ll be cautious about putting in any serious money. There are plenty of risks with the company, but I have to admit, the volatility makes it kind of exciting.

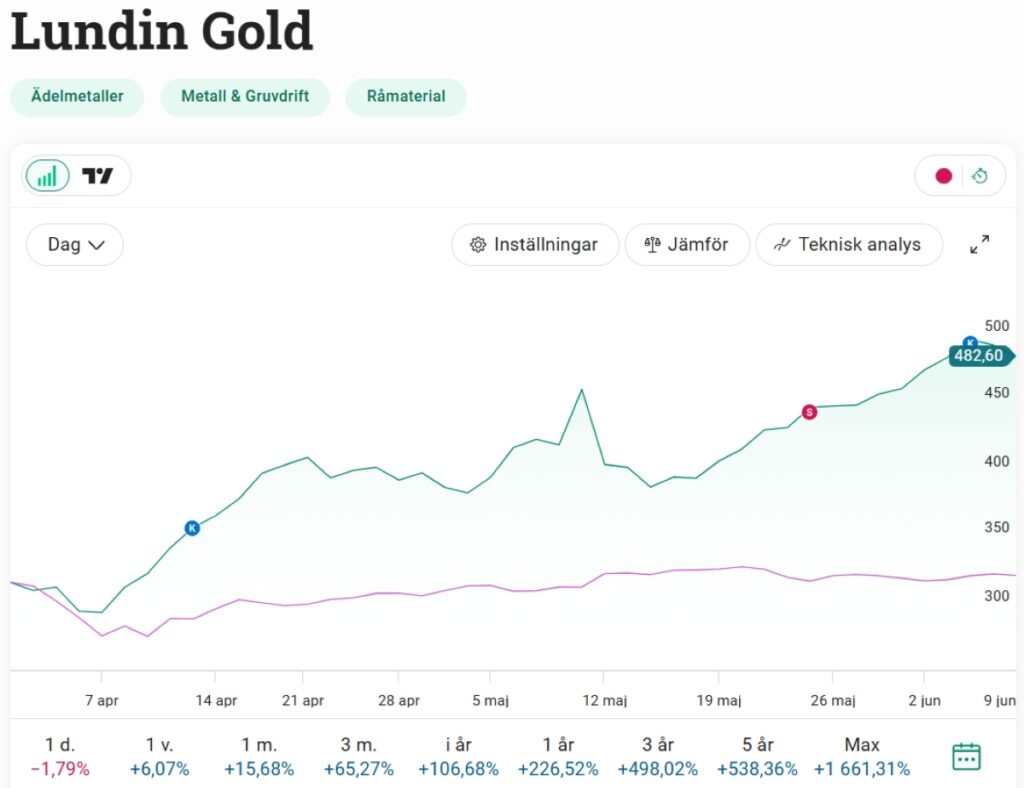

Lundin Gold

I’ve both bought and sold Lundin Gold. I wanted to increase my exposure to Swedish-listed stocks, and this one has performed very well. After I sold, the stock kept climbing, so I re-entered with a smaller position, just to keep following it closely. This is the kind of stock that can rise very quickly, but also drop just as fast.

Fragbite Group

One thing worth mentioning is that I’ve finally gotten rid of a real dead weight: Fragbite Group. I liked the idea of a Swedish company in the gaming industry. E-sports seems to be gaining traction, but it’s a tough sector, and the company has suffered a series of setbacks. Even though there’s a lot in the pipeline, it just doesn’t seem to deliver.

I made the mistake of averaging down, which I normally try to avoid, but this time I fell into the trap. The result was a big loss, though I managed to sell before it got even worse. If I had held on, the loss would have been bigger. A painful but important lesson.

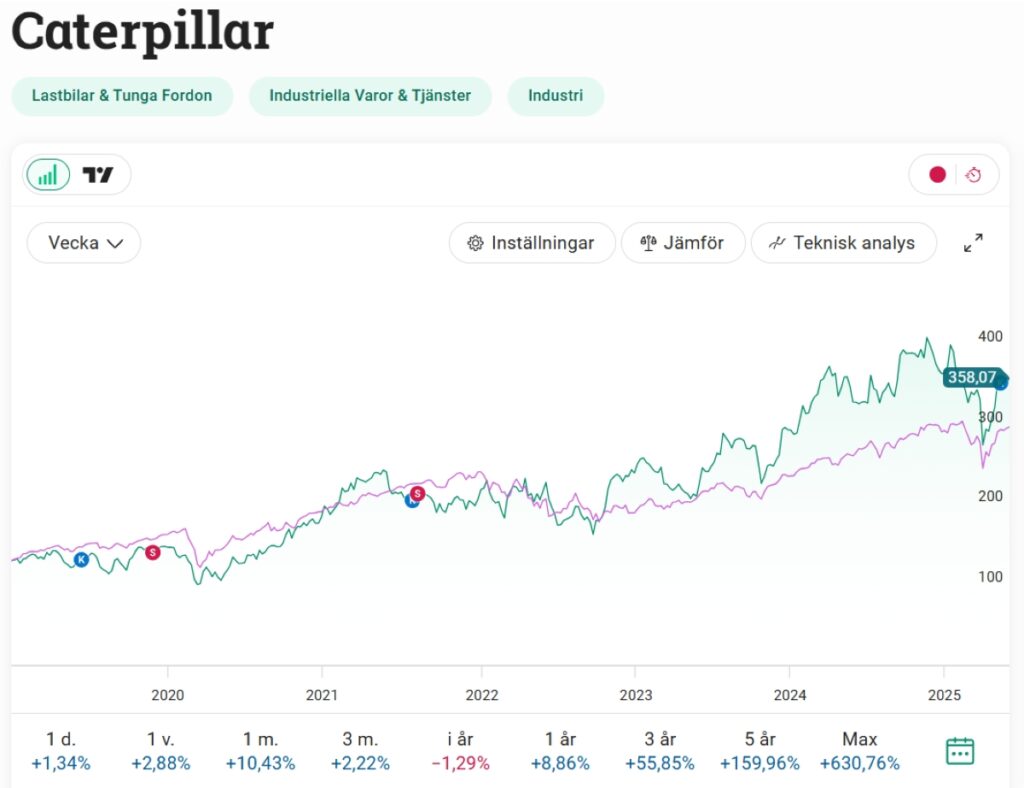

Caterpillar

To shift toward a more defensive position, I reinvested the Fragbite money into a much more stable company: Caterpillar. It might have something to do with all the roadworks I’ve driven past lately, but it really feels like Caterpillar machines are in demand. They make solid equipment, and with all the infrastructure projects going on and a constant need for raw materials, this stock feels like a solid pick.

The company also invests heavily in innovation, which makes it more than just a “safe bet”. Geopolitical tensions could affect the share price short-term, but long-term, I believe in this company.

I’ve Spent Less Time Than Ever on the Portfolio

Given the recent turbulence, it hasn’t felt that exciting to log in and check the portfolio. Plus, Tradera is the other reason I haven’t been logging in much. Lately, I’ve actually made more money there than on the stock market.

I’ve decided to take a break from Tradera in June and July, although I still have a few listings with fixed prices that expire at the end of June.

Watching the Summer Market

Keeping an eye on the summer market will be interesting. Since I won’t be selling on Tradera I’ll have more time to follow the market swings. What I’m most looking forward to are the earnings reports. I’ll be paying close attention to:

- JP Morgan Chase & Co

- American Express

- Tesla

- Microsoft

- Enphase

- Apple

- Caterpillar

- United States Antimony

Finally, Vacation

As I write this, I’m finally settling into vacation mode. I don’t have any big plans for the summer, my main focus is to recharge. For me, that means plenty of reading in the garden and soaking up some sunshine.

Last summer I went to London, and I’ll end with a photo of me by the Chinese Pagoda in Victoria Park.

Wishing you all a wonderful summer!

I just have to be clear that I’m not a licensed financial analyst. I’m not giving any advice. This blog post is just pure inspiration. Remember, you’re investing at your own risk!