My New Strategy

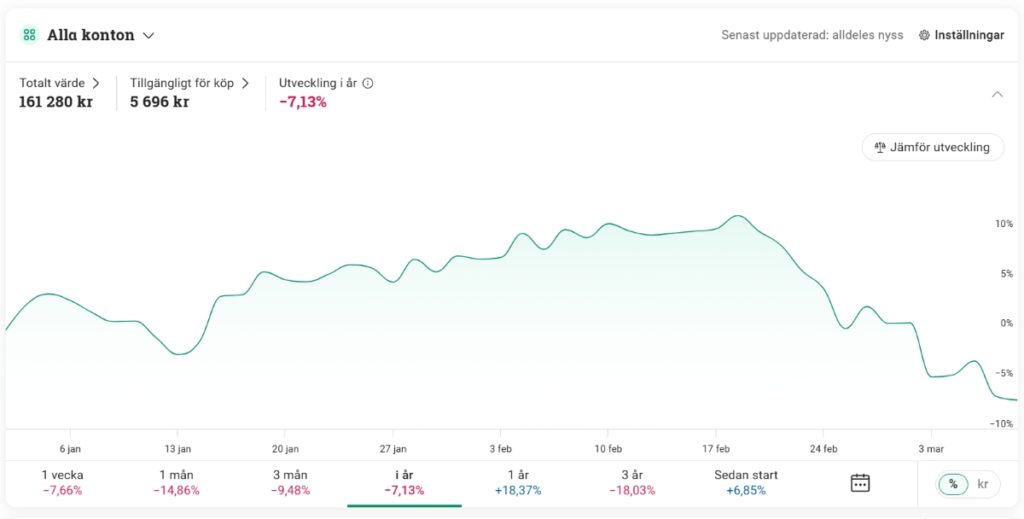

With the new year I started a new investment strategy shifting from a focus on dividend stocks to active trading. Initially, trading went well, but recent events have shaken things up. Since the start of the year, my portfolio has swung from +10% to -7%. The primary reason for this decline is my heavy exposure to technology and industrial stocks. Additionally, I have some direct and indirect investments in crypto.

I Can’t Stay Away from Bitcoin

On January 30, I purchased Bitcoin certificates in a small position to ensure I had a stake in case of a price surge. Almost immediately after I bought in, Bitcoin dropped, and the downtrend has continued. From what I understand, macroeconomic factors are the main drivers behind this decline. I want to buy more, but I’m holding off for now. If we’re in a prolonged downtrend, it could take time to recover. With the next halving expected in 2028, it still feels too early to start accumulating. Currently, I’m down 25%.

![]()

The Index I Follow Has Taken a Hit

In the fall of 2023, I chose to add an S&P 500 tracker to my strategy to balance my exposure to high-risk assets. On January 22 of this year, I entered another position. Since then, the index has dropped by 14%. My options are to hold and wait for a rebound or add to my position if the index falls by 20%. Finding the absolute bottom is nearly impossible, but I’ll do my best.

![]()

I Want to Keep Owning Nvidia

Nvidia has been a fantastic stock to own, and I’ve been trading it for quite some time. The earnings report at the end of February was strong, so on March 4, I decided to buy more shares. Their products are in high demand now and will likely continue to be in the future. Nvidia plays a crucial role in the AI revolution, providing essential components. However, market conditions can shift rapidly, and recent events have shown how quickly things can change.

I Finally Sold Alibaba After Years of Holding

I first bought Alibaba on November 5, 2020, believing it to be a stable, steadily growing stock. Then the major decline happened. Alibaba is a massive company with multiple divisions and ongoing investments in future projects, which is why I maintained confidence in its long-term potential. I averaged down my position several times and eventually reached a profit. That’s when I decided to sell. After holding the stock for years, I simply couldn’t wait any longer.

And Then the Stock Went Up More

Frustratingly, Alibaba’s stock rose after I sold. However, I didn’t want to hold out for the next earnings report. In this case, securing a small but guaranteed profit felt like the right choice. There’s always a chance I sold too early, but I have many other investment opportunities that interest me more.

A Test of Patience and Endurance

The fact that I eventually made a profit on Alibaba is a reminder that averaging down can work, even when things seem bleak. The challenge is that it can take years. In hindsight, I might have been better off taking a loss earlier and reallocating that capital elsewhere. Still, patience and long-term thinking do pay off.

I Focus on Other Things

Reading forums and following market opinions has influenced me too much in the past. Especially during my obsession with dividend stocks. Time passes regardless, and I need to spend it doing things I enjoy rather than constantly stressing over my portfolio’s performance. Logging in too frequently and seeing too many red numbers could tempt me to sell at the wrong time. So, my strategy now is to focus on other things. I write, read, and occasionally play video games, like Final Fantasy XII: The Zodiac Age and Animal Crossing: New Horizons. I’m also selling some of my dad’s old things on Tradera.

The Journey Continues

Writing this post wasn’t easy, given how unpredictable the market is. Right now, I may not be on track to reach my goal of 200,000 SEK by 2025, but the market is constantly changing. A month from now, things could look entirely different, just as they could in five months or even five years. What matters most is staying committed, learning from my experiences, and trusting that in the long run, perseverance and patience will pay off.

I just have to be clear that I’m not a licensed financial analyst so I’m not giving any advice. This blog post is just pure inspiration. Remember that you invest on your own risk!